The smart Trick of Home Improvement News That Nobody is Discussing

Wiki Article

Get This Report about Home Improvement News

Table of ContentsThe Of Home Improvement NewsThe 25-Second Trick For Home Improvement NewsAll about Home Improvement NewsMore About Home Improvement News

By making your house a lot more protected, you can really make a revenue. The interior of your house can obtain obsoleted if you don't make adjustments and upgrade it from time to time. Interior style styles are constantly transforming as well as what was trendy five years ago might look ludicrous now.You could also feel tired after considering the same setting for many years, so some low-budget changes are constantly welcome to give you a little bit of adjustment. You pick to integrate some traditional aspects that will certainly continue to appear present and also trendy throughout time. Do not worry that these restorations will be expensive.

Pro, Tip Takeaway: If you really feel that your house is also little, you can renovate your basement to boost the amount of space. You can utilize this as an extra space for your family members or you can lease it out to create added income. You can make the most of it by employing professionals that give renovating services.

The Only Guide for Home Improvement News

Residence remodellings can improve the means your residence looks, but the advantages are much more than that. Check out on to find out the advantages of residence remodellings.

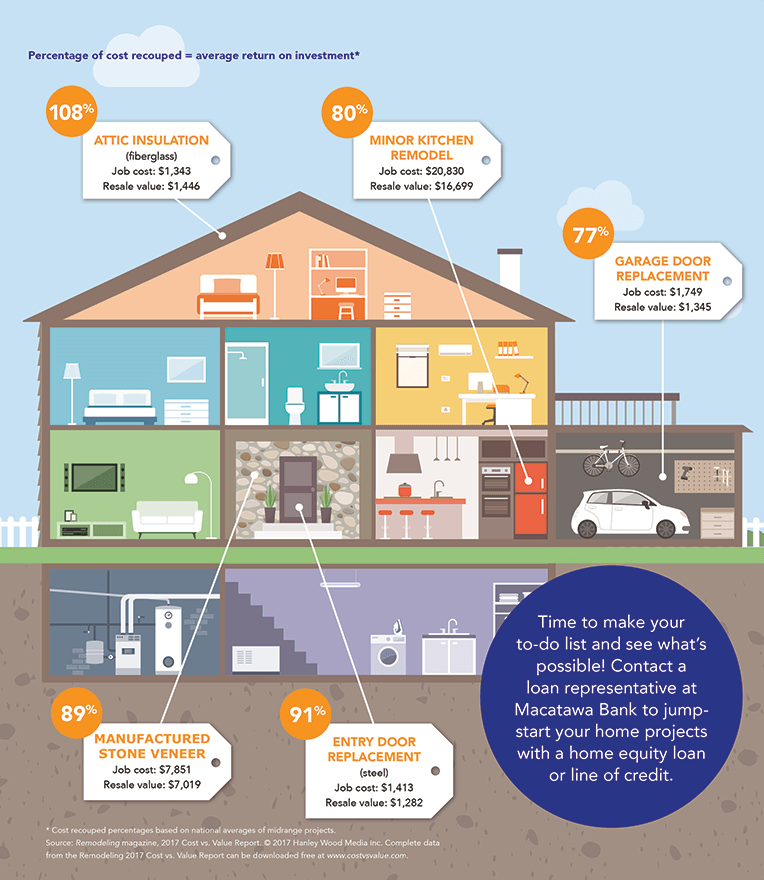

Routine residence maintenance and also repairs are necessary to keep your residential or commercial property worth. A residence improvement can assist you preserve as well as boost that value. Using a house equity finance to make home improvements comes with a couple of benefits that other uses do not.

Indicators on Home Improvement News You Should Know

That set rate of interest indicates your monthly repayment will certainly correspond over the term of your lending. In an increasing rates of interest atmosphere, it might be much easier to factor a set payment into your budget plan. The various other option when it involves tapping your house's equity is a residence equity credit line, or HELOC.You'll only pay rate of interest on the cash you have actually obtained during the draw duration, however, typically at a variable price. That indicates your monthly settlement goes through change as prices rise. Both residence equity car loans as well as HELOCs utilize your house as collateral to safeguard the loan. If you can't manage your month-to-month settlements, you might lose your residence-- this is the biggest risk when obtaining with either kind of lending.

Consider not simply what you desire now, but what will certainly interest future customers because the tasks you choose will impact the resale value of your residence. Collaborate with an accountant to see to it your passion is effectively subtracted from your taxes, as it can save you tens of thousands of bucks over the life of the financing (commercial property management).

The Only Guide to Home Improvement News

Residence equity financings have reduced passion prices contrasted with various other kinds of financings such as personal loans as well as charge card. Present residence equity rates are as high as 8. 00%, yet personal fundings go to 10. 81%, according to CNET's sibling website Bankrate. With a house equity financing, your rate of interest will certainly be taken care of, so you do not need to bother with it going up in a increasing passion price atmosphere, such as the one we're in today.As discussed above, it matters what kind of renovation projects you embark on, as certain home enhancements provide a greater return on financial investment than others. For instance, a small kitchen remodel will certainly recover 86% of its value when you sell a house compared to 52% for a timber deck addition, according to 2023 information from Redesigning publication that evaluates the expense of remodeling tasks.

While home values have actually escalated over the last 2 years, if residence rates drop for any factor in your location, your financial investment in enhancements won't have actually pop over to this site raised your house's value. When you wind up owing extra on your mortgage than what your residence is in fact worth, it's called unfavorable equity or being "underwater" on your home mortgage.

A HELOC is frequently better when you want extra versatility with your lending. With a fixed-interest rate you don't need to fret regarding your settlements going up or paying much more in rate of interest with time. Your month-to-month repayment will certainly always be the very same, no issue what's happening in the economic situation. All of the money from the car loan is dispersed to you upfront in one repayment, so you have accessibility to every one of your funds immediately.

Report this wiki page